The Bank understands the criticality of environmental challenges and the benefits of transitioning towards a low carbon economy. Therefore, in line with SDG 13 which is undisputedly one of the important focus areas today, there is an urgent need to combat climate change. Climate change can and will affect the way the Bank does business, including impacting its lending portfolio, risk management frameworks and future strategy. The Bank measures and discloses its GHG emissions with full transparency. In FY 2018-19, there has been a decrease of about 11% in absolute combined Scope 1 and Scope 2 emissions due to the implementation of EnMS and various other energy saving initiatives through the Bank offices and branches. There was a change in methodology and use of emission factors in the calculation of fuel consumption, contributing to the decrease in emissions.

The Bank has undertaken steps to sensitise its stakeholders on various emissions reduction initiatives which include measures to adopt digital banking channels, energy efficiency initiatives and paper conservation measures. Emissions other than Scope 1, 2 and 3 for example SOx, NOx and SPM are not material to the Bank as it operates in the service sector. Currently the measurement of coolant leaks as part of Scope 1 emissions are not being captured; the process for recording the measurement is in progress and will be reported in the next reporting period.

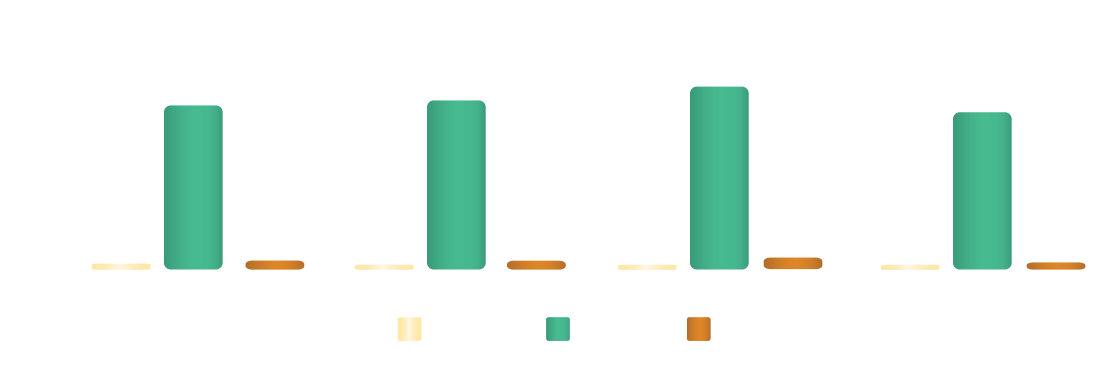

Scope 1, Scope 2 and Scope 3 Emissions (’000 MTCO2e)

Calculations of Scope 3 emissions for FY 17-18 were revised following a re-evaluation of the Bank's GHG inventory. Revised Scope 3 emission figures of FY 2017-18 calculates to 26.8 MTCO2e. The decrease in scope 3 figures compared to FY 17-18 is as result of a decreasee in emissions from taxi hires and paper consumption.

Note

1. Scope 1 emissions include CO2, N2O and CH4 emissions from HDFC Bank’s owned vehicles. The emission factors and GWP (Global Warming Potential) values have been taken from India GHG Program, 2015. The cost of diesel consumed pan bank is converted in quantities consumed by using state level diesel prices. The emission factors have been taken from CEA’s (Central Electrical Authority) CO2 database and India GHG Program, 2015.

2. Scope 2 emissions include MTCO2e emissions from electricity consumption and diesel consumption by gensets at HDFC Bank. The emission factors have been taken from CEA’s (Central Electrical Authority) CO2 database and India GHG Program, 2015. The cost of electricity consumed pan bank is converted in quantities of electricity consumed by using state level tariffs. Grid Electricity Consumed has been calculated from the electricity bills for all locations.

3. Scope 3 data includes Business Travel by the employees (Air and Rail), Taxi hire, Paper consumption, and E waste. The emission factors have been taken from India GHG Program, 2015. The total amount of distance travelled for the various sectors is determined to calculate the emissions generated from Business Travel.

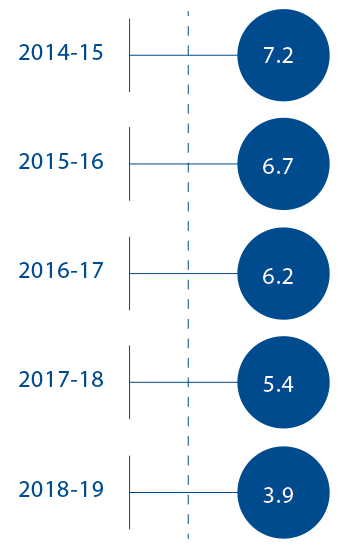

MTCO2e per ₹ Crore

of Total Income

Considering the increase in Net Income, GHG emissions intensity (combined scope 1 & 2 emissions per unit income) at the Bank has decreased by about 27%, attributed to the initiatives at the Bank, to reduce energy consumption.

Carbon Footprint Calculator

The Bank creates awareness about emissions and carbon footprint through its Carbon Footprint Calculator that can be accessed through the following link :

https://www.hdfcbank.com/htdocs/aboutus/csr/Carbon-FootPrint-Calculator/index.html

This calculator enables an individual or a family to calculate their carbon footprint based on their travel and residence. Additionally, it also recommends methods to offset this footprint.

For any queries or questions

regarding the report or its contents,

contact:

Nusrat Pathan

Head, Sustainability & Corporate Social Responsibility

HDFC Bank Limited

[email protected]

All Rights Reserved.