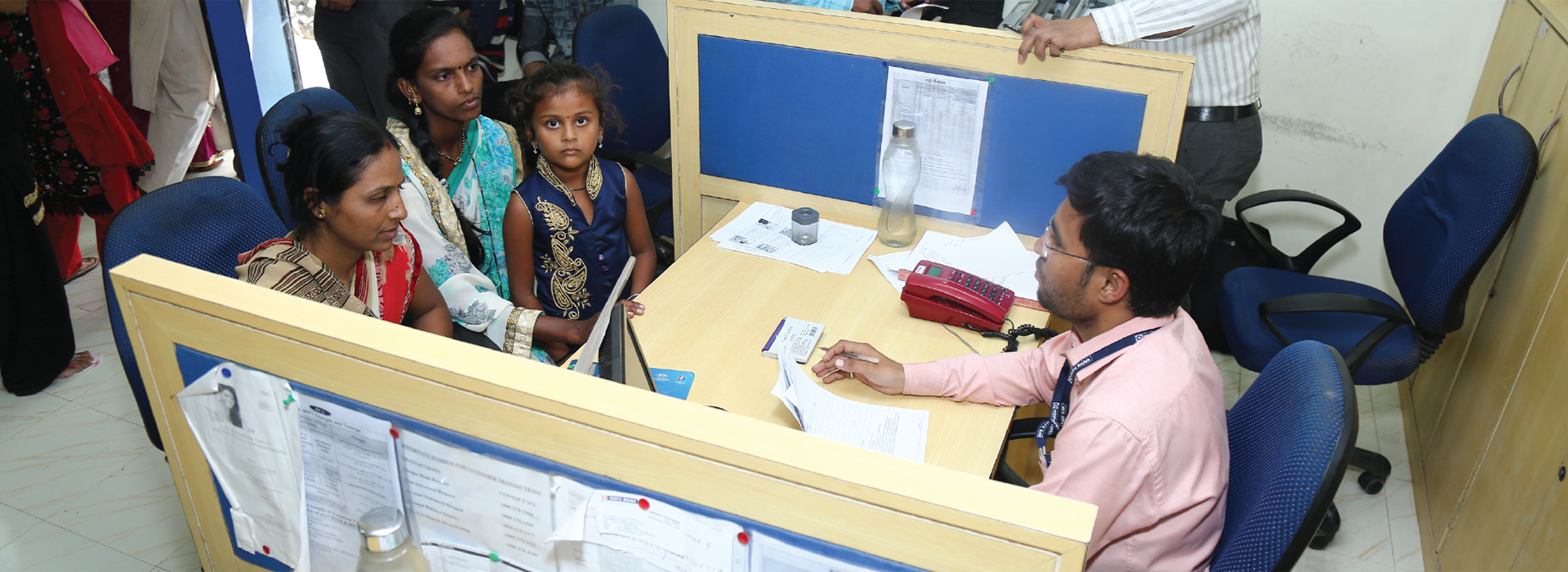

The Bank strives to create a cordial relationship with its key stakeholders, with the aim of creating value over time and delivering sustainable growth for them. Stakeholder satisfaction is of paramount importance for the progress of the Bank.

The Bank has identified its key stakeholders’ such as shareholders/investors, employees, customers, society, regulators and suppliers and engages with them regularly through various formal and informal forums. This helps in identifying their issues and concerns and engaging with them to address them suitably.

Stakeholder Engagement And Management

The banking sector witnesses change in regulations, inflation, price levels, rate of economic growth, national income, gross domestic product (GDP) and rapidly changing customer behaviors. Thus, it is pivotal for the Bank to understand internal and external views, perspectives and concerns with respect to their products, services and operations. This helps in meeting the changing requisites of customers, society and the environment.

The Bank aims to engage with all its stakeholders in a sustained manner. The process of communicating or interacting with stakeholders is referred to as Stakeholder Engagement. It helps an organisation achieve a desired outcome and enhance accountability.

The Bank has a mature mechanism in place, to engage with its key stakeholders. The engagement helps to determine their priorities which enables the Bank to undertake measures to address them and thus develop stronger relationships. The Bank is committed to disclosing its performance on sustainability parameters, in a transparent manner. It also intends to address the key impacts (positive and negative) across the value chain.

Identification of key stakeholders has been done with respect to their influence on business and operations and vice versa.

Key stakeholders of the Bank are:

The Bank engages with these stakeholders through various channels at regular intervals. Please find below, details of our engagement with stakeholders.

| Stakeholders | Stakeholder key interest / Concerns | Mode of engagement & Frequency | HDFC Bank response |

| Customers |

|

Online Communication, Customer Satisfaction Surveys and Feedback |

|

| Investors /Shareholders |

|

Meetings and calls with individual Investors. Quarterly Reports, Investor Meets, Press Releases, Annual General Meeting |

|

| Employees |

|

Performance appraisals,Training, Programs, Emailers |

|

| Community |

|

Regular meetings. Focus Group Discussions, Project Monitoring and Reviews |

|

| Regulatory bodies |

|

Regular meetings. Policy Updates and Ministry Directives, Mandatory filings with regulators including RBI and SEBI | Awareness generationon Aadhar linkages and PMJDY |

| Suppliers |

|

Regular Meetings, Phone Calls and Surveys | Ensure timely payment for services,Whistle-Blower Policy to ensure good practices |

BLUE = External Stakeholders, GREY = Internal Stakeholders

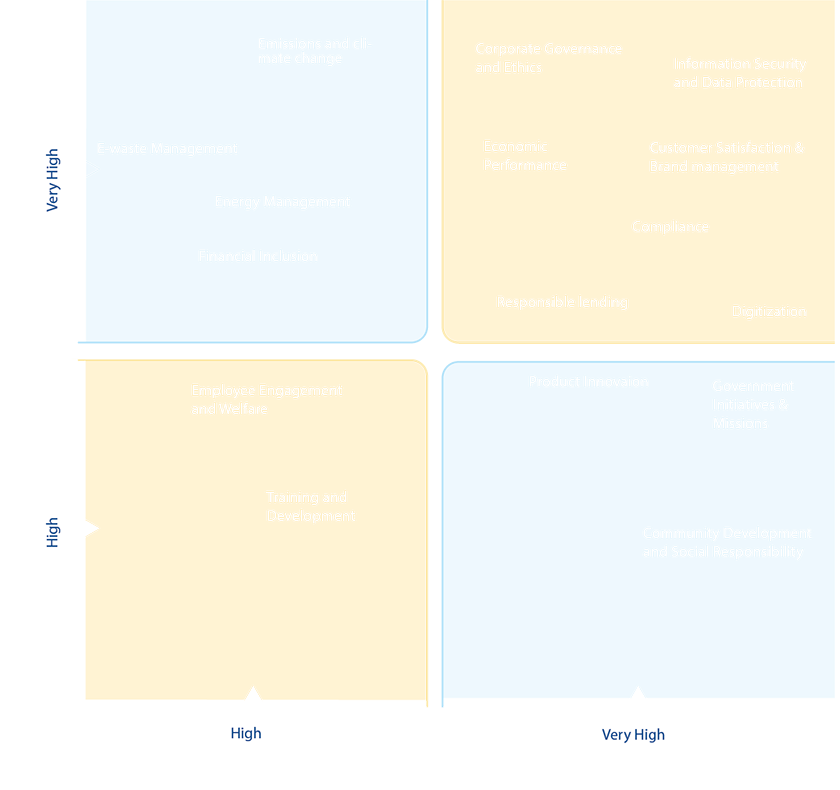

Materiality Assessment & Matrix

Determination of the material issues for the Bank is done through engagement exercises conducted with identified stakeholders. Stakeholder base for the Materiality Assessment included employees, customers, investors, vendors and our community (NGO) partners.

The process encompasses the listing of various relevant material topics from a background study including review of peers, GRI Standards, other relevant frameworks. Most relevant focus areas are then shortlisted and used for the stakeholder engagement exercise basis discussion with the CSR Committee of the Board. The methodology for stakeholder engagement is mentioned below:

The responses received from the exercise are analysed and used to derive the Materiality Matrix. The Materiality Matrix highlights relevant and priority economic, social, environmental and governance topics for the Bank and its stakeholders. Responses from more than 3300 stakeholders were received and analyzed in FY 2018-19. These stakeholders were also engaged to understand their views on the Bank’s Community development initiatives and Sustainability journey, besides their opinion on material topics.

Materiality Matrix

For any queries or questions

regarding the report or its contents,

contact:

Nusrat Pathan

Head, Sustainability & Corporate Social Responsibility

HDFC Bank Limited

[email protected]

All Rights Reserved.