Transitioning towards a low carbon economy is the need of the hour. HDFC Bank has been at the forefront in identifying, assessing and addressing environmental concerns and has been measuring its greenhouse gas (GHG) emissions since 2010. Addressing and mitigating environmental concerns also makes business sense as climate change impacts have the potential to not just impact operations but also revenues, by impacting our lending and investments. The Bank is firmly committed to the environment and the fight against climate change. The Bank regards climate change mitigation and environmental conservation as essential elements of sustainable business. This belief embodies the Bank’s approach on management of its resource footprint. With the aim to measure and disclose GHG emissions with full transparency, in FY 2018-19 the Bank has undertaken GHG Assurance from a third party. The Bank is committed to minimizing its carbon footprints.

A Board-governed environmental policy serves as a framework to understand and manage the Banks environmental risks, impacts and opportunities. By implementing policy directives and adopting best global environment practices, the Bank hopes to achieve a 10% reduction in its Scope 1 and 2 emissions intensity by FY 2021-22. The Bank has aligned itself to the SDGs and works towards integrating them into its business strategy.

Energy Management

In alignment with SDG 12, the Bank endeavours to improve energy efficiency and systematically manage energy use throughout its operations. The adoption of Energy Efficient Management Systems (EnMS) has led the Bank to achieve the same. With the installation of Energy Management Module, the Bank has been able to reduce power consumption by about 12% across 600 branches, where this has been implemented. As on 31st March 2019, two of the Bank’s buildings at Mumbai and Bhubaneswar are LEED certified.

12% reduction in

power consumption

(at each EnMS

implemented branch)

Highlights

Emissions and Climate Change

The Bank understands the criticality of environmental challenges and the benefits of transitioning towards a low carbon economy. Therefore, in line with SDG 13 which is undisputedly one of the important focus areas today, there is an urgent need to combat climate change. Climate change can and will affect the way the Bank does business, including impacting its lending portfolio, risk management frameworks and future strategy. The Bank measures and discloses its GHG emissions with full transparency. In FY 2018-19, there has been a decrease of about 11% in absolute combined Scope 1 and Scope 2 emissions due to the implementation of EnMS and various other energy saving initiatives through the Bank offices and branches. There was a change in methodology and use of emission factors in the calculation of fuel consumption, contributing to the decrease in emissions.

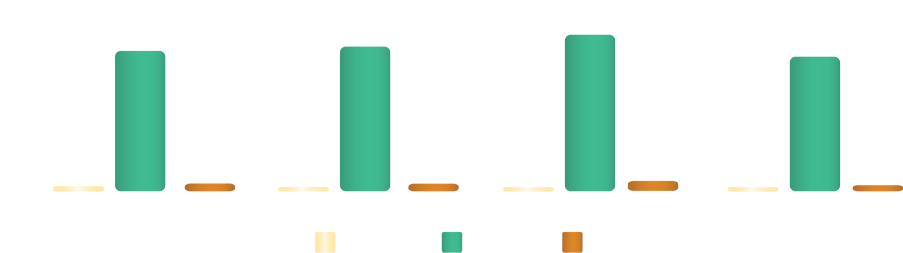

Scope 1, Scope 2 and Scope 3 Emissions (’000 MTCO2e)

Waste Management

Aligning with SDG 12, to achieve sustainable management and efficient use of natural resources, the Bank is constantly on the look-out for opportunities to recycle waste. The wastes generated through the Bank’s operations are e-waste, dry waste (primarily paper waste) and wet waste (primarily from the cafeteria). Diesel/fuel oil from its DG sets is the only hazardous liquid waste generated from the Bank’s operations. This too is negligible and is hence not significant in the purview of its overall footprint. The Bank ensures that the domestic waste (Sewage) from offices and branches are not let into water bodies.

Digital Banking

In line with its Digital Strategy, the Bank has gone digital, eventually reducing the consumption of paper. Several processes have been automated and made paperless. The Bank has set up systems to reduce paper consumption in all its offices, where a centralised stationery desk manages most requirements. In FY 2018-19, the Bank saved more than 51,000 sheets of A4 paper by means of automation of approval and payment processes within the IT department.

About 90% of the Bank’s transactions in FY 2018-19 were carried out through digital banking using web and mobile applications.

For any queries or questions

regarding the report or its contents,

contact:

Nusrat Pathan

Head, Sustainability & Corporate Social Responsibility

HDFC Bank Limited

[email protected]

All Rights Reserved.